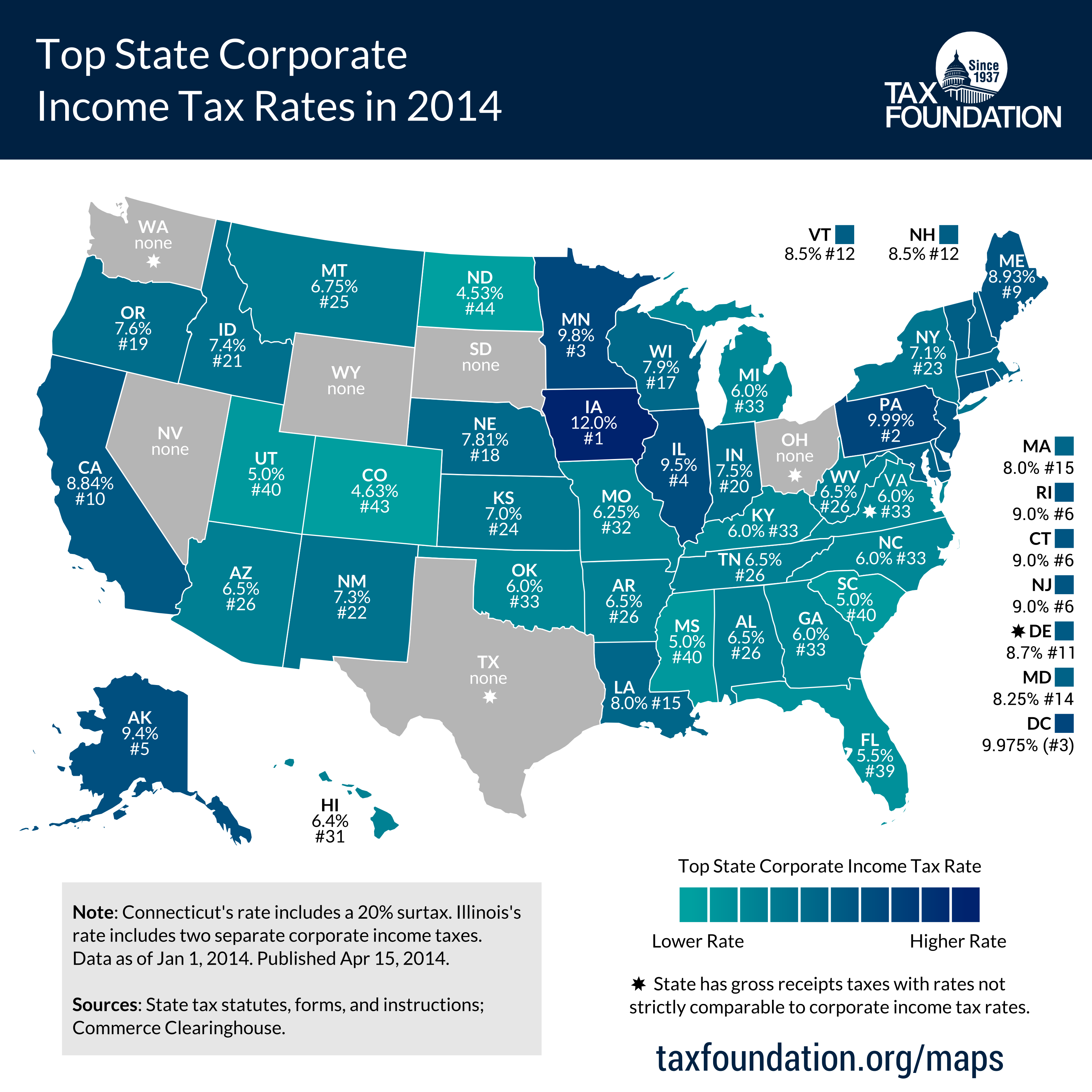

b&o tax rate

B O Tax. The rate of taxation is not uniform for all businesses.

The B O tax rate.

. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Income from exempt activities need not be listed on the B O tax return. If a due date falls on.

Rather different types of businesses are taxed at different rates depending upon their classification by the Washington State Legislature and the Washington State Department of Revenue. V voter approved increase above statutory limit e rate higher than statutory limit because rate was effective prior to January 1 1982 ie grandfathered. Kenmores BO tax applies to heavy manufacturing only.

If you need to file a 2021 annual tax return and have revenue. Some defenders of the BO tax say the system has the virtue of being much harder to avoid. When paying the B O tax to the Department of Revenue you declare your income in different categories.

Washington has created an additional BO tax rate under the Service and Other Activities classification to fund Workforce Education. For more information please see the City of Renton Business and Occupation Tax Guide or Renton Municipal Code RMC. Items claimed as dedu.

If a taxpayer had taxable income of 1 million or more in the prior. The IRS provided legal guidance on the new rates in Announcement 2022-13 PDF issued today. Washington unlike many other states does not have an income tax.

The gross receipts BO tax is primarily measured on gross proceeds of sales or gross income for the reporting period. The following chart gives the rates for each main category. Tax Rate Line 12 - The BO tax rate for the City is 110 of 1.

Business Warehouse Floor Space - 4000 taxable square feet. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. Businesses that are required to pay BO tax do not pay the Per Employee Fee.

Although there are exemptions every person firm association or corporation doing business in the city is subject to the BO tax. Any license fee or tax due and unpaid and all interest and penalties thereon are considered a debt to the City and may be collected in the same manner as any other debt. Classifications and Minimum Thresholds.

These new rates become effective July 1 2022. However the law allows cities that had a. The major classifications and tax rates are.

Seattle is currently the only city with a voter-approved BO tax higher than 02. The Seattle business license tax is applied to the gross revenue that businesses earn. The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes.

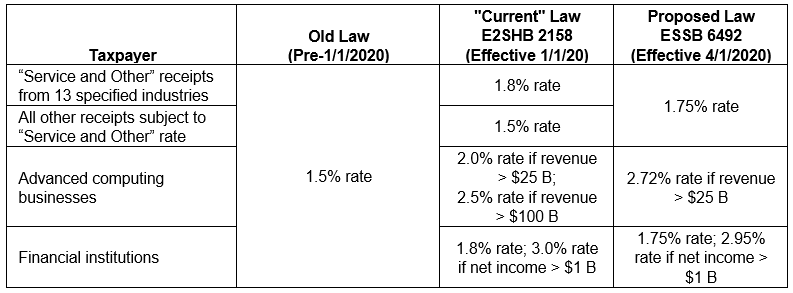

BO tax is due for businesses with annual companywide gross receipts over 500000. There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year. Effective April 1 2020 the BO tax will be imposed at two separate rates under the Service and Other Activities classification.

Contact the city directly for specific information or other business licenses or taxes that may apply. The state BO tax is a gross receipts tax. Both Washington and Tacomas BO tax are calculated on the gross income from activities.

It is measured on the value of products gross proceeds of sale or gross income of the business. Most businesses fall into the 110 of 1 rate including Retail Service such as restaurants and clothing stores. They then apply that rate to their gross receipts and cut Washington a check.

Business Occupation Taxes. Services and Other Activities What most businesses fall into. The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications.

The City Business Occupation BO tax is a gross receipts tax. Depending on your situation filing your Seattle taxes may be relatively simple or fairly complex. Businesses receive a classification with a corresponding tax rate.

It is measured on the value of products gross proceeds of sales or gross income of the business. Most classifications come with a tax rate below 1 percent which is low. Service industry businesses have the heaviest tax burden with a tax rate of 15 more than triple the other major classifications.

All businesses are subject to the business and occupation BO tax unless specifically exempted by Auburn City Code ACC. How much is the BO tax. Businesses with gross receipts of 15 million or more per year earned within the City of Renton will be required to file and pay BO tax.

Most Washington businesses fall under the 15 gross receipts tax rate. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent. Be careful in calculating the tax owed.

For purposes of the gross receipts tax business activities have been divided into several classifications discussed below. Washington unlike many other states does not have an income tax. BO TAX RATES Based on Gross Receipts Extracting 0017 Manufacturing 0017 Retailing 0017 Wholesaling 0017 Services and other activities 0044 BO TAX SCHEDULE Tax returns must be filed for each period even if no tax is due.

Service providers such as CPA firms architects attorneys and doctors those who do not normally pay sales tax fall into the 210 of 1 rate. The additional tax is imposed at a rate of 12 of gross income taxable under the Service and Other Activities classification thus making the effective BO tax rate for these institutions 27. If youre unsure how your business is classified the Department of Revenue provides a list of common business activities and their corresponding tax classification s.

Service and Other Activities. This means there are no deductions from the BO tax for labor. Washingtons BO tax is calculated on the gross income from activities.

The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate effective at the start of 2022. For retail businesses where the BO tax is based on gross receiptsincome the maximum tax rate may not exceed 02 of gross receipts or gross income unless approved by a simple majority of voters RCW 3521711. Heres how the state BO works.

It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. The tax amount is based on the value of the manufactured products or by-products. Multiply the Total Taxable Amount by 0001.

Have a local BO tax.

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

B O Tax For Auburn Businesses Here S What You Need To Know Auburn Examiner

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

A Guide To Business And Occupation Tax City Of Bellingham Wa

County Surcharge On General Excise And Use Tax Department Of Taxation